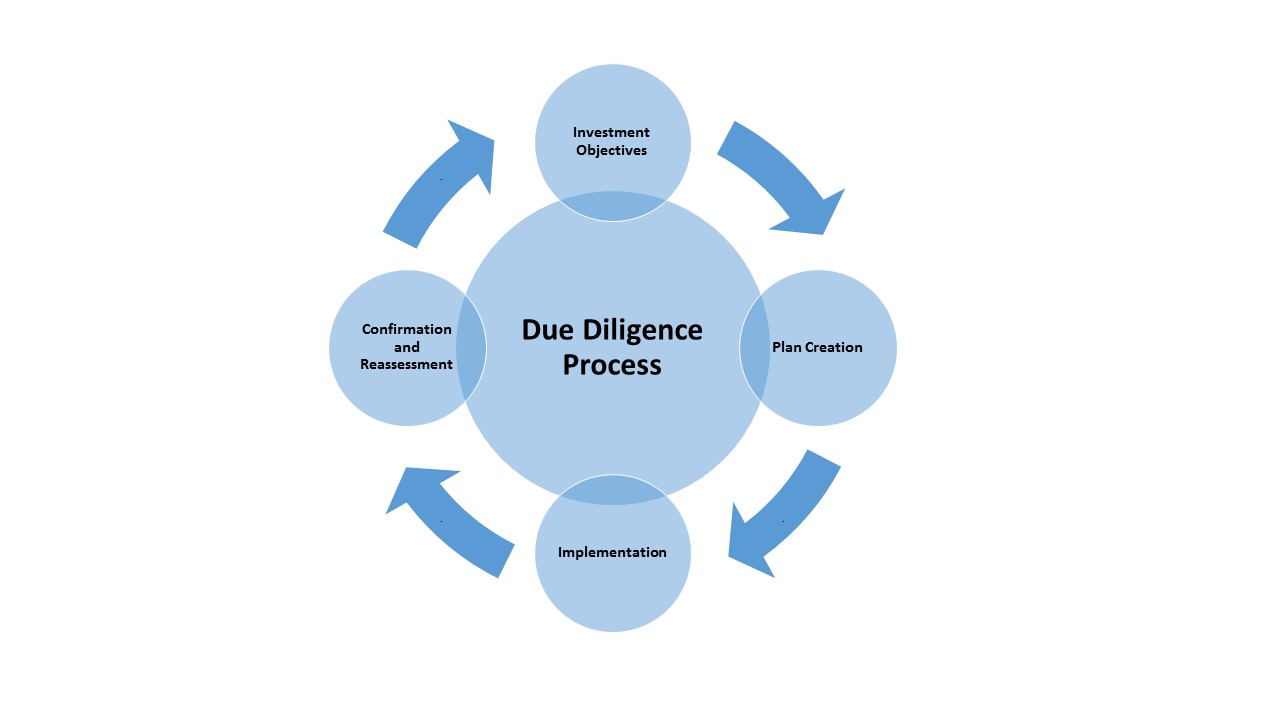

The Merus portfolio construction process begins with knowing our client. We recognize and embrace that fact portfolios should fit the needs, objectives and risk tolerances of the people that own them. We build portfolios with these characteristics in mind and always with a connection to our due diligence process. Our institutional quality research process allows us to thoroughly understand underlying investment strategy characteristics such that we can match them with those of the client. This enables Merus to build the most appropriate portfolio for each of our clients.

The Merus investment process is repetitious because circumstances can change over time. Our quarterly reporting and review process helps us the stay in touch with our clients' state of affairs and the suitability of their investments.

1. Discovery of Investment Objectives

We work closely with our clients to discover their goals, risk tolerance and constraints by analyzing their entire balance sheet. We then discuss the attributes and risks of select investment strategies to ensure suitability.

2. Plan Creation

Each client brings unique characteristics to the relationship. We seek to create a customized plan of attack to address the client's specific financial goals. We implement only thoroughly researched investment solutions that are typically drawn from within the universe of alternative investments.

3. Plan Discussion and Implementation

Our clients hold discretion over all investment decisions. As such, all aspects of any wealth solution or strategy are thoroughly vetted via discussions with clients. All aspects of plan implementation are carefully monitored by the Merus team and always within an open and transparent communication loop with the client.

4. Ongoing Confirmation and Reassessment

Merus seeks to be as tactical as it is strategic. Investment themes and theses are updated and communicated to clients as circumstances and characteristics change. All investments are under continuous evaluation in an effort to deliver best in class results.