Four Tenets of the Merus Philosophy

-proactive portfolio management-

-customized allocation approach-

-consistent performance objective-

-capital preservation Mandate-

We manage a dynamic asset allocation process. One static allocation model is neither appropriate for all investors nor for all environments. Our approach is in stark contrast to that of the typical broker who tends to operate under the one size fits all philosophy and promptly shoehorns all investors into the same or very similar investment allocations.

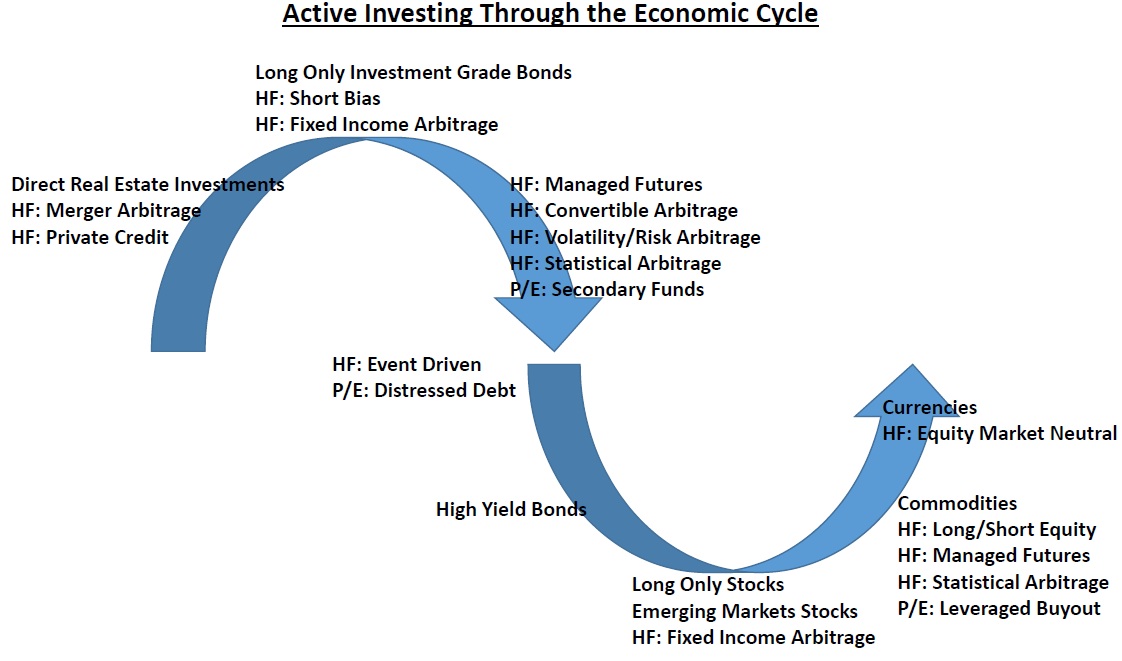

By carefully listening to our clients we seek to identify their unique needs and objectives. Further, we believe it is imperative to understand the economic setting and how it relates to investing towards the clients objectives. Because the investment environment is always changing, it is constantly creating new opportunities, dislocations and risks. One of the drivers of that change that we focus on is the economic cycle, or the natural transition of the economy between periods of growth (expansion) and recession (contraction), and all points in between. Specific investment strategies are better suited to outperform depending on which stage we find ourselves within the cycle. In addition to other inputs, our proprietary Economic Indicator model aids us in forming views regarding key economic metrics. By identifying transition points as the cycle shifts from phase to phase, we can better manage risk and/or deploy into opportunities.

While we take a long term approach to investing, we believe that value can be added through a dynamic and opportunistic approach to asset management. We seek to position our clients' portfolios to exploit current opportunities as well as to be prepared for where we believe future opportunities will emerge. Conversely, we seek to pare risk in portfolios by avoiding strategies not suited for a given economic phase. We do this largely within a core and satellite allocation approach.

In reference to the Economic Cycle graphic below, from left to right the four phases are: growth, decline, recession and recovery. Currently, we believe the economy is in the later upswing of its growth phase.

After forming a consensus on the phase of the economic cycle we then evaluate risks and opportunities by weighing market dynamics. Based on this information we can formulate an opinion on investment strategies and which ones may provide the most appropriate portfolio specific, risk-adjusted propositions. This consensus is then used to construct portfolios to each individual's specific needs and objectives. Our goal is to deploy assets into opportunities that can provide consistent, positive performance with a focus on principal protection - typically with a low or negative correlation to traditional markets. We are proponents of alternative investments because of their idiosyncratic and distinctive return characteristics. By mitigating market risk and its accompanying volatility, we believe our clients' portfolios are positioned to compound returns more effectively and, in turn, create more wealth. This proposition holds the potential to shift the portfolio's risk-adjusted return to the northwest; less volatility and higher compounded returns.

Merus seeks investment opportunities from any and all asset classes and types including: real estate, private credit, hedge funds, private equity, direct investment opportunities, or distressed scenarios that offer a compelling margin of safety.